Now that the property market is opening up, and we are coming out of lockdown, prospective buyers are searching for their dream first home to make their lives complete. Cosy, intimate flats furnished with neutral plush rugs, and minimalist paintings, are contrasted with tumbledown cottages, charming and petite, crawling ivy to add to a fairytale picture. Sprawling eco-friendly houses with acres of farmland, black and white cows liaising with brown horses, as they compete for ‘their human’s’ attention. But how can first time buyers get on the property ladder?

Buying a house, especially your first home is a complex process, and there is a lot that you need to consider. For a start, can you afford it? Are you in a financial position to buy a house, flat or cottage and not feel uncomfortably out of pocket? After all, the average deposit for first-time purchasers in London is a whopping £100,000, which can seem like a daunting figure. With property prices increasing over the years, misinformation about mortgage deals, and an inevitable mortgage crunch, has deterred many first-time potential owners.

However, by taking a strategic approach to budgeting and leveraging the right financial products, first-time buyers who are serious about buying in the capital can see their dreams come true. With the recent budget announcement by chancellor Rishi Sunak, aiming to turn ‘generation rent’ into ‘generation buy’, the 95% mortgage scheme is back, which only requires a 5% desposit. This is a chance for first-time buyers to have easier access to the property ladder than they would have had during lockdown.

So, if you want to turn your dream of owning your own home into a reality but don’t know where to start, this guide for first-time buyers will offer you practical, no-fluff advice. From speaking to a mortgage advisor and broker, to considering government schemes such as ‘Help To Buy’, or getting in the habit of saving, and planning for your future – here are 5 ways that first-time buyers can get on the property ladder.

Work Out Your Budget And Speak To A Mortgage Advisor

If like me, you have been renting for most of your working life, and have never owned your own home, you might be wondering as to how first-time buyers get on the property ladder. Not only do you need to consider a breakdown of the costs involved in buying a property, but you also need to create a realistic budget so that you can see what you can afford. Before looking at a property you will need to save for a deposit.

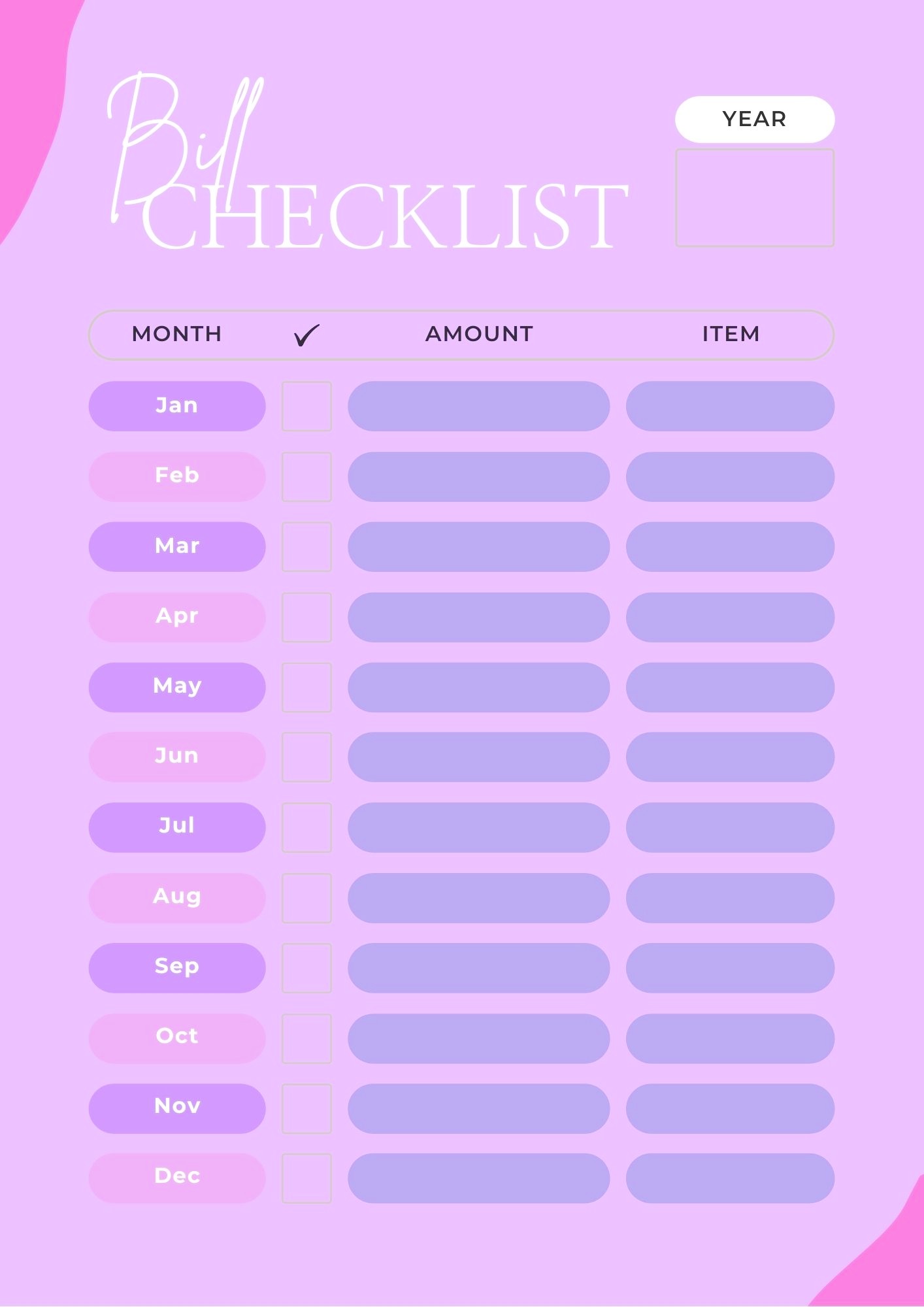

Generally, without considering the new 95% mortgage scheme, you need to save between 5% to 20% of the cost of the home you would like. For example, if the house you would like costs £150,000, you would have needed to save at least £7,500 (5%). You should also save money for mortgage arrangement and valuation fees, and stamp duty. The temporary stamp duty is being extended in England and Northern Ireland, so until the 30th of June, the first £500,000 spent on a property will be tax-free.

After that, the threshold will drop to £250,000 until 30th September, where it will then return to its normal of £125,000. To calculate the stamp duty on your prospective home, you can use The Money Advice Service stamp duty calculator, which will ask you the price of your property, and then ask whether you are a first-time buyer or buying a second home. Stamp duty must be paid on completion of your property which your solicitor will carry out the payment on your behalf.

But how do you work out your housing budget and how much you can afford? After all, financial anxiety is very real, and you don’t want to stress yourself out by spiraling because you don’t know how much you need to save for your property, or what budget you need to stick to each month. This is why talking to a mortgage broker or advisor can really help you make the right decision and show you how first-time buyers can get on the property ladder with ease.

From helping you set a budget that works for you, organising your DIP and guiding you through the steps involved until you are the owner of your new home, a mortgage advisor and broker are with you every step of the way. They will even talk you through the different types of mortgages available, explain what stamp duty is, and the approximate fees of solicitors, so that you have a clear understanding of the costs associated with buying your first home or any property. If you are looking for help with an existing mortgage or are buying a second property, they offer solid advice.

From helping you set a budget that works for you, organising your DIP and guiding you through the steps involved until you are the owner of your new home, a mortgage advisor and broker are with you every step of the way. They will even talk you through the different types of mortgages available, explain what stamp duty is, and the approximate fees of solicitors, so that you have a clear understanding of the costs associated with buying your first home or any property. If you are looking for help with an existing mortgage or are buying a second property, they offer solid advice.

Get In The Habit Of Saving And Plan For Your Future

It should go without saying, but it’s important that you save as much money as possible so that you can move into your dream home, and not worry about massively living beyond your means. After all, while deposits tend to be between 5-20%, the average first-time buyer puts down a 15% deposit according to Zoopla. With the average first-time property costing around £220,000, that equates to a hefty £33,000. Of course, as I mentioned earlier, there are cheaper properties available at a 5% deposit, but still need at least £7,000 to put down a deposit.

It is important to watch your pennies when saving for your home, but also ensure your bank account conduct does not have a negative effect on obtaining a mortgage. When you apply for a mortgage some lenders may request your bank statements, your bank habits are then assessed especially for those lenders who allow for 95% lending. They will be checking to see if you use your overdraft, and in addition how frequently, they may also look for any payday loans, and if you do online gambling.

But how can first-time buyers get on the property ladder without ‘scrimping’ to the extreme? After all, a recent study by Quick ISA showed that a quarter of British adults have no savings, with more than half of the survey respondents wishing they could save.

Of course, saving is difficult, and I am not going to sugarcoat it. Saving up for your first home does take a lot of blood, sweat and tears but the results are worth it. Imagine the satisfaction you will feel when you have saved enough money as a first-time buyer to get on the property ladder successfully. Part of this process is learning to micro-invest, putting away small amounts of money regularly which adds up over time. While it requires consistency and discipline, when you set realistic ‘money-saving goals’ you can achieve your heart’s desire.

The key is to be realistic, and look over how much you earn a month, how much you can realistically save after paying your bills, rent and food, without being in a financial situation where you are constantly anxious about earning, spending, and saving money. After all, I have been in that unhealthy money mindset before, and not only is it obsessive, but it is extremely unhealthy and can affect your mental health.

To start with, break down your ‘dream of buying your own home’, into small manageable steps. That way, instead of jumping into the deep end and buying a house that you can’t afford, you can tick off your progress along the way, and put away savings each month, until you have enough money to move.

Take Control Of Your Outgoings And Cut Excess Costs

Speaking of savings, it is important to adopt a money manifestation mindset, so that you can control of your finances and cut excess costs. Create two separate budgets, one for your necessity budget which includes rent, bills, business costs and anything else that is essential, and then track how much you are spending on luxuries. Luxuries can include spending money on clothes, streaming networks or eating out.

You might see that you are spending £200 each month on luxuries and see that you can half your ‘luxury monthly budget’ by cutting excess costs. You can cut £100 by reducing the number of takeaways you get each month, buying own-brand food in your weekly shop from the supermarket, and using comparison sites to get the best deals on your bills so that you are paying less.

For example, I am someone who in the last year has been extremely careful with her money, because I’ll be moving into a property with my partner in September. I’m used to scrimping and saving (and have been in debt before), so it’s not a position that I want to be in again, where I have to sacrifice everything just to get by. I rarely buy new clothes anymore, have very few takeaways, and am traveling less because of lockdown, which has helped me save more money than I would have been able to do before lockdown.

If you want to learn how first-time buyers get on the property ladder successfully, you’ll need to be financially astute. For example, let’s say you are a freelancer and earn a different amount of income each month, which makes micro-investing that much harder. Are there any luxuries that you could swap for cheaper products? Do you have some clothes, jewellery, or run a small business and can make a small amount of money on the side? Look at the ways that you can make a passive income to add to your first home fund.

Let’s say that you also have a car, which as we all know is incredibly expensive, and be a huge financial drain. But do you need it? As someone who lives in East London, and has great transport connections, shops, and amenities nearby, there would be no point in me having a car, because I can save money by taking a train, bus or even cycle if I want to be extra financially conscious. Look at the premium things that you own in your life and work out whether there is a necessity there or whether you can cut that cost out, to save more money long-term.

Take Steps To Improve Your Credit Score And Pay Off Debts

No matter how small or big your debts may be, paying your debts on time, or off can affect your affordability with a lender. If you are in a lot of debt and are still spending a lot of money, you can be in jeopardy, because the mortgage lender may deem the mortgage not affordable. If you have finances for example a car or credit card it is important you pay it within the conditions you agreed to. When they see that you are consciously managing your finances carefully, you’ll have greater access to mortgages.

One thing to note is that you need to pay off your debts in the right order, reducing the borrowings with the highest interest rates (usually credit cards) first. Speaking of credit cards, if you do pay it down fully, phone the provider and shut down the credit cards as this will increase your credit rating, but also a lender don’t like it when a person has access to too much credit even if not used. If you are struggling to understand how first-time buyers get on the property ladder, evaluating credit scores is a good shout. After all, your credit rating influences if a lender will lend to you.

Consider Government Schemes To Get You On The Property Ladder

As I mentioned earlier, Rishi’s new 95% mortgage scheme encourages banks and building societies to offer 95% mortgages again. This is so we can move away from renting and start buying our first property with government support. The 95% scheme gives banks a chance to buy a guarantee on the portion of the mortgage between 80% and 95% so that if a borrower gets into financial difficulty, the government will cover that chunk of the lender’s losses. But how does it benefit the first-time buyer?

Well, it enables you to borrow up to 95% of the purchase price of the property you want to buy, with the remaining 5% made up of your deposit. A 5% deposit could help you get on the property ladder sooner, as you will need to save less of a lump sum.

If you are looking for an alternative mortgage scheme, the Help to Buy allows you to buy a new-build home with a deposit of just 5%, with the government offering a five-year interest-free loan for a further 20%. As a first-time buyer, you also don’t need to pay stamp duty on the first £300,000 of a home’s purchase price, so long as it’s under £500,000.

What Are Your Tips For First Time Buyers?

*Disclaimer

Please note this is a collaborative post with Mortgage Light but all thoughts are my own and are not affected by monetary compensation.

Leave a Reply