With 15.1 % of the UK labour market registering as self-employed in 2017 (according to the Office For National Statistics) in comparison to 12.10 % in 2001, a record 4.8 million men and women are learning how to become self employed, citing ‘economic disparity’ or uncertainty as a trigger for employment change. Surprisingly in 2017 the OFNS found that unemployment rates had fallen to just 4.3%, with the rise of self-employment counteracting the downturn of ’employee jobs’ as more civilians seek ‘alternative ways’ to make an income in an economic climate fraught with instability. While many of us, including myself sought ways on how to become self employed as we were already ‘dabbling in it part time’, for others self-employment was always the end goal, with graduates seeking to create their own businesses or inventions that they believe would not only empower them but also A. potentially create jobs for others and B. enable them to create a business empire and a legacy. But learning how to become self employed in the UK is not as easy as it looks; from learning how to deal with HRMC (which still gets my brain in a spin) to learning about unique tax reference codes and keeping track of financial earnings, there is more to self employment than meets the eye.

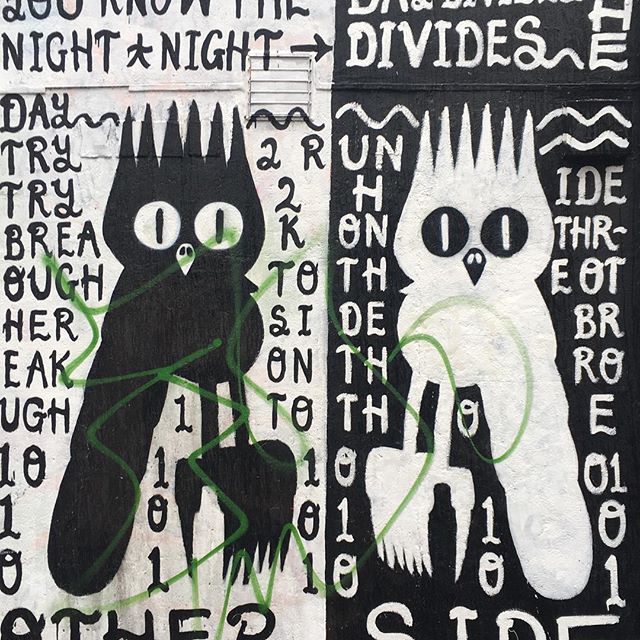

Work By Envol Studio In Pedley Street

Establish Why You Want To Become Self Employed

For me whilst working in marketing and journalism, I was also working on my blog and a bar job at weekends, but blogging was my true passion. Having wanted to start a blog in second year of university, it wasn’t until I graduated that I actually started a blog and what a cathartic form of release it was. But nevertheless as a writer, I was still hoping that I would enjoy my full time job more than I actually did, although the reality of working in journalism and marketing is A. less money than you think, B. being a small cog in a factory of corruption and C. often needing to write ‘points of view’ that you didn’t necessarily agree in,which from an ethical perspective did not sit right with me. Creating unbiased articles is quite difficult for me as I am a passionate, emotive writer but the fact that we were often not credited for our achievements or not rewarded for our hard work is what really got to me. Which is why I was so drawn to blogging full time and while I might not have the best financial stability right now, I am still proud of myself for following my heart instead of settling in a job that made me very unhappy.

And this is what you have to do as well. If you are going self employed because you think it will be easy or have grand fantasies about becoming ‘rich quick’ trust me it isn’t going to happen. But if you are reading up on how to become self employed because you want to go outside of your comfort zone or want the flexibility of working from home then congratulations girl its winner winner, veggie chicken dinner. Now ask yourself this; does the thought of becoming self employed fill you with equal parts dread and excitement, does being your own boss make you want to jump out of bed in the morning and most of all is it having a positive impact on your mental health? Alongside establishing the reasons as to why you want to become self employed, it is so important to assess whether your heart is really in it. Because coming from someone who is their own boss, it sure as hell isn’t easy, but it is god damn rewarding.

Work By Envol Studio Star Yard

Create A Self Employed Checklist And Be Sure To Check It Twice

Like any job learning how to become self employed has its trials and tribulations. From not knowing where you are going to get your next pay check, to joyous bills and rent that you can’t afford it can feel overwhelming to say the least. And trust me as someone who is more than happy to admit that Maths is not her strong suit, I totally get why you would be stressed. Which is where my concept of a self-employed checklist comes in, guaranteed to ensure that your transition into self-employment is as smooth as possible.

Step 1: Determine as to whether you are going to become a sole trader or limited company. For example if you are registering as a self employed blogger, then you will be putting yourself down as a sole trader, whereas if you are setting up an events company you will be registering that as a ‘Limited Company’ as its more tax efficient and has the benefit of limited liability. Please note that as of 2018, the first 11,500 is tax free (which means that you would need to make roughly £958.34 each month) whilst you are taxed 20% of your income up until 45,000, 40 % up until £150,000 and then £45,000 on income over £150,000.

Step 2: Be Sure To Set Some Money Aside And Plan Your Transition In Advance. To be honest I wish that I had followed my own advice because not only did I have barely any money saved but I also leaped into self-employment without having a clue what I was doing. While it worked for me, as I needed to do what was best for my mental health at the same time, I am still suffering the after effects of my ill preparation, as every month is a struggle to pay my rent because quite honestly I am not earning enough from blogging to afford basic living costs. At the same time I work extremely hard and I know that as times goes on, things will get a little easier for me and my self employed friends. Besides, while I struggle financially, I know that I made the right decision to quit my full time job and I don’t regret my choice at all. And I would also like to point out that all of my earnings go on travel, rent and bills and its very rare that I will actually spend money on myself. So while some people will say they ‘have no money’, I literally don’t have money to save. But always keep an optimistic attitude as I know there is a rainbow waiting to be discovered on the other side.

So my advice to anyone who is planning to quit their job, look at how much your living costs are and then work out how much you would need each month to survive on . For example lets say your rent is £700 and your bills are £200, then you spend £200 on travel each month and £150 on a food shop each month, which leaves you a grand total of 1,250 of expenses that you need to shell out for, which in all honesty is quite a lot of money that you would need each month.

Step 3:Tell HMRC that you’re self-employed. It seems like an obvious point to make but it goes without saying that you should notify HMRC with a change in your employment status. To register you can go to the government’s website so that they know you need to pay tax through self-assessment and pay Class 2 and 4 National Insurance contributions. Please bear in mind that some tenancy agreements have terms and conditions about ‘self employment’ and while that has never been an issue with any of my landlords, its better to be safe than sorry.

Step 4: Get A Unique Tax Reference Number. You may be asking yourself as to why you would need a unique tax reference number and what relevance it has to your self employed status, especially if you are a sole trader. Well put simply a UTR number identifies you as a self employed tax payer and in some cases blogging SEO agencies and brands might ask for your UTR in order to clarify your self employed status. You will also need to have this to hand when completing a self assessment tax form so that HRMC can see your full earnings within that tax year.

Step 5: Track Your Earnings. There is nothing worse than filling in your self-assessment form and not having a clue as to how to fill it in. And while taxes do get me in a spin, I have figured out that spreadsheets really are a godsend when it comes to keeping track of your earnings. In my spreadsheet I keep track of my expenses each month, wht I am owed by companies for each month and potential clients, alongside dates for meetings, phone calls, events, trips, places to review and more because while it might seem like it, trust me, I am not the world’s most organized person.

Work By DSscreetsheet On Bacon Street

Don’t Be Ashamed To Ask For Help

Learning how to become self employed is scary and its probable that you might be confused and are unsure of whether you have filled in your self assessment form correctly, are unsure as to how to contact HRMC or even have some other queries that need answering. Let me tell you something is better to ask for help if you are unsure as otherwise worst scenario you can be slapped with a tax fine and trust me if you have no money that is never fun to stress out over. From websites like Talk Tax, who have a series of helplines on learning how to become self employed- whether that be reporting a change in circumstances or simply asking for help on how to register, don’t be afraid to pick up the phone and ask for help. And if speaking on the phone is not your cup of tea , you can contact your local citizens advice bureau who might be able to arrange appointments in person or even speak to your bank and local job centre who can give you advice on how much you would need to earn each month, whether you are financially stable-in my case no- or simply offer you some words of encouragement and support that can determine as to whether you are making the right decision.

Of course making the choice to become self employed is never an easy decision to make but in my eyes there is no harm in trying. Because there is no such thing as failure, only mistakes and the only mistake you will be making is not allowing your dreams to have a chance to shine. So whether you want to become a full time blogger, want to start your own clothing company or simply want to fund your own start up, in 2018 the possibilities are endless. Question is what will you choose?

Are You Self Employed Or Are You Looking To Become Self Employed? If So What Do You Do?

*Disclaimer

Please note this is a collaborative post but all thoughts and research are my own.

Loved this post! Having only just registered as self-employed spreadsheets are doing my head in but it’s worth it 🙂

I certainly applaud you, Anna, for following your heart and jumping head-on into being self-employed. Sometimes I wonder if that’s truly the only way to do it because if you’re at the point of sink or swim, it forces you to swim. You’re right, there are so many things to think about when you become self-employed. Have you found a mentor who might help guide you through some of the specific nuances in the U.K.? Also, are there any breaks if you’re a woman owning her own business? For example, here in the states, there are breaks for women who own construction companies. So when a friend of my husband’s retired, he set it up under his wife’s name. Food for thought .. xx

Great post! Love this.