As someone who is a freelancer and is self-employed (alongside a full time job), I adore the freedom of working for myself, and setting my own hours. There is nothing that is more thrilling than knowing that you prospect your own clients, are responsible for your own success and learn new transferrable skills along the way. As a Creative Copywriter, Content Writer and Blogger, I have my fingers in a lot of pies, and relish the unpredictability of working for myself. While being your own boss is dynamic, it can be hard to find ways to save money when you are self-employed.

Because you ‘find your own work’, set your own retainer, and create your own portfolio, you don’t have a steady income each month. There can be months where your earnings are meagre, and you struggle to get by, while other months might have better paying clients, huge projects and an influx of work and income. You might find credible and legit ways to make money from home, and thrive in an environment where your ‘earning potential is uncapped’. It’s important to be mindful of the pros and cons of working for yourself.

Being your own boss and being responsible for your own finances can be energizing. After all, your hard work has put the money in your bank and Paypal account, you have independence, control and freedom from routine, and can take as many or as little clients as you want each month, as long as you have a monthly budget to work torwards. However when you unsure when you will get paid, how many clients you will have each month, and whether you have enough to pay your bills, that can be extremely worrying!

I always say that the positives outweigh the negatives, and if you are someone who enjoys a role that is unstructured, has potential for unlimited earnings and working from home, then being self-employed has it’s benefits. I love being able to work from anywhere, be in charge of my own financial destiny, and relish being able to choose my own hours as a freelancer. Having financial freedom is incredible, but it’s important to know how to plan ahead.Which is where this guide to knowing how to save money when you are self-employed comes in.

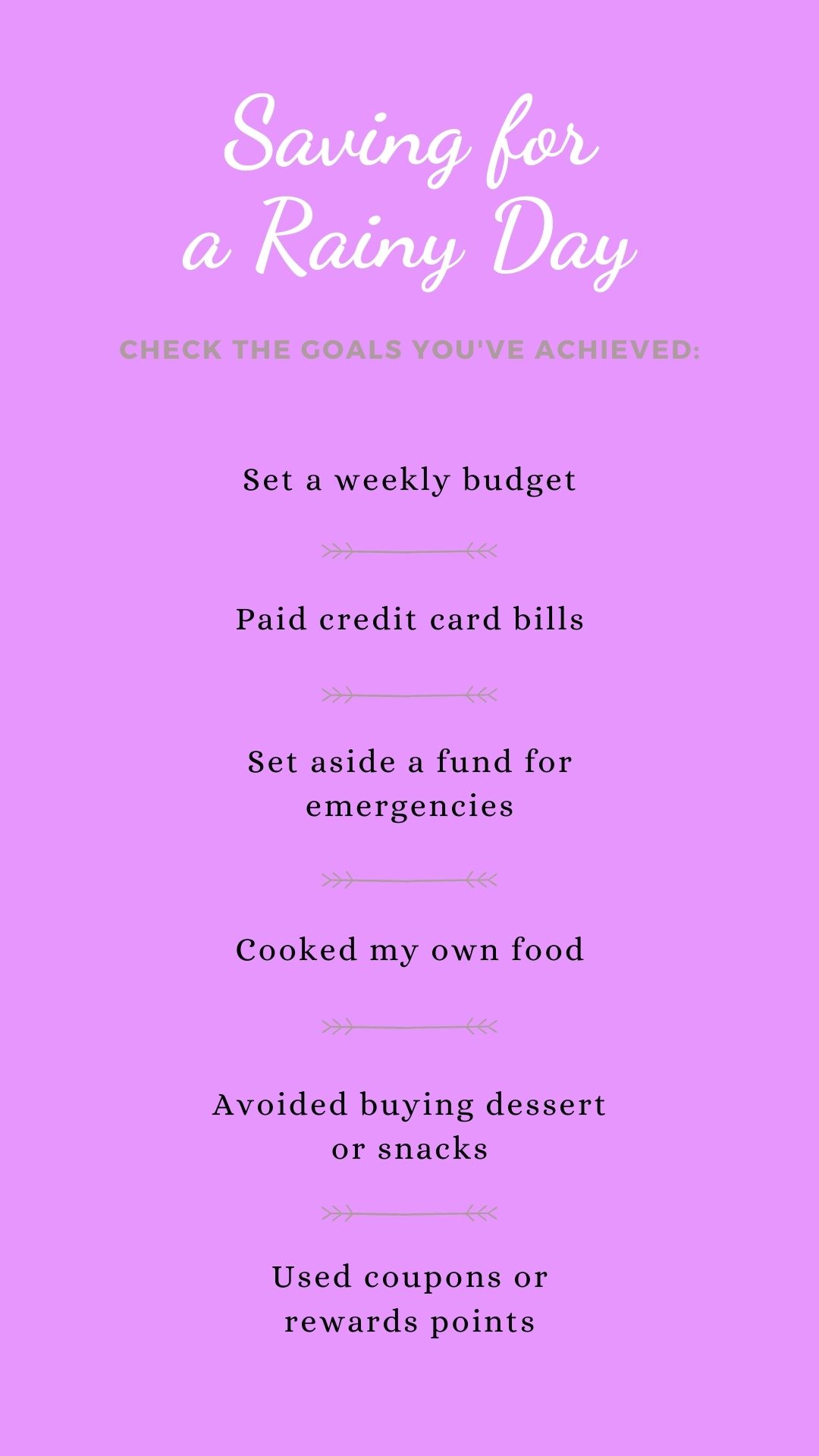

From creating a budget each month and cutting out ‘luxuries’, to having confidence in your finances and making smart choices, here are 5 key ways to save money when you are self-employed, without breaking a sweat. If you have financial anxiety, and money worries like myself, you will know that being able to put aside a little money each month, goes a long way to support your business and help you invest in your future.

Create A Budget Each Month And Cut Excess Spending

The day to day financial planning, and management of your money can be tricky for those who get financial anxiety. If you find budgeting incredibly difficult or are new to being a sole trader, knowing how to save money can be easier said than done. After all, you are responsible for your own taxes, have self-assessment forms that you have to manage and don’t have the benefits of getting holidays or sick days, because you are not working as a contracter. There are cases where you might get a contract which can protect your worker’s rights but it is rare.

Which is why you should create a monthly budget and keep on top of your spending. To assess ‘how much you would need to spend’ and how much you would need to save each month, it’s important to priortize the ‘absolute neccessities’ that you have to pay for. For example let’s say your rent is £650, you pay £250 on bills, and have a side business which needs £200 for domain and hosting costs and SEO services.

That’s already 1,100 that you need to pay each month, so if you only earn £1300, that will only leave you with £200 to spend on food, travel or anything else. If you are earning less than what your costs are each month, then you will be in a deficit, so it’s important to try and take on work that matches your financial needs. It could be that on top of this, you are spending £100 each month on luxuries such as streaming websites, eating out, going to the cinema ect. You would say that your ‘neccessity budget’ would be £1300 (£200 for the cost of food).

It could be that you are on a higher salary, and after tax are earning £1700 per month. You spend 1,200 on rent, bills and small business costs, and factoring in food and travel you spend £300. This also means that you have £200 left over, but from looking at your bills, you spend £70 on entertainment costs such as Netflix and Prime, £50 on new clothes and £80 on eating out at resturants and having drinks.

While we all need to be able to ‘treat ourselves’ and have fun, we also have to be mindful that spending that £200 means that you have absolutely nothing saved, and because you don’t earn a lot, and have high ‘neccessity costs’, this makes ‘luxury costs’ less affordable. You don’t have to cut all your streaming networks or feel afraid to treat yourself, but priortize the luxury treats if you are looking to save money when you are self-employed. For example, have you got Netflix, Prime and Hayu? Cut the two networks that you use the least.

Want to be able to go to bars and resturants? Priortize where you go each month. For example one month you can buy new clothes, and the next month can be focused for a monthly treat at your favourite resturant and so forth. Even if you are saving an extra £100 each month, you can put this away for the next month or towards a seperate cash fund, and watch it build over time.

When you are self-employed it can be difficult to predict the costs, or even what income you are getting as you don’t always know, but you can work out how much you would need to earn to live comfortably. Let’s say that you are renting at £650, bills are included, and you need £250 to cover your phone bill, insurance, and small business costs with £300 allocated for travel and food each month. Your costs would be £1300, which would be your neccesity budget, and this month you’ll be making £2,000, leaving £700 in the bank.

You could allocate £150-£200 to your ‘luxury budget’ and then have £500-£550 each month saved, in case of any unexpected purchases such as a laptop repair, having to pay for a new camera, or signing up for an important blogging course on SEO so that you could optimize for your website. As you earn an ‘unstable income’ each month, I always like to set aside money, even if it is just £50, and use my Paypal account as my ‘treat account’, where I can treat myself to something that I really want once a month. It can be as simple as a new book or a new jacket.

Because you don’t earn a consistient income, no two months are the same, so I like to create a ‘monthly average’ that helps me see what I am earning for my ‘freelance work on average’ a year. It gives me a rough idea of how much I can spend each month, but also shows me that a bad month does not define my earnings, and neither does a successful one. It’s important to mull over considerations to make before you become self-employed, so you have a clear idea of what you are getting into. Remember, as you are self-employed, you can claim money back on travel and business expenses, so be sure to keep a record of all business receipts and track your expenses throughout the year.

Protect Your Loved Ones And Get Life Insurance

It might sound like ‘doom and gloom’ but it is so important that we protect ourselves and our loved ones, when we are freelancing. After all, knowing how to save money when you are self-employed is not just about investments, and saving money for a rainy day, but also about planning ahead. Whether that is getting life insurance, putting money aside for funeral care, or looking into business insurance, make smarter life choices today. After all, insurance is so important for small businesses or sole traders, because they don’t have the same rights as those who are employed.

For example, when you work for yourself, you don’t have access to holiday days, sick pay and don’t have the security of a steady stream of clients, meaning that money could be tight. When it comes to being ill, or even dying, your income will become wiped out, potentially putting your loved ones at risk. After all, you don’t have a pension scheme which you often have in employed jobs, and essentially have no rights.

It’s shocking but unfortunately being self-employed does come with some risks, meaning that if you die on the job without life insurance or critical illness cover, your loved ones can be left with nothing. This is why it is vital that you look into life insurance cover, so that you can feel reassured knowing that your loved ones are being taken care of. The death of a loved one is hard to deal with, so companies like Heart of England Funeral care, helps you plan for the future, so that when the time comes, your family can find it easier to process their pain.

Funerals are not cheap, so planning ahead will help you save money in the long run. Whether you want to talk about a funeral, a pre-paid funeral plan, or just have a chat, thinking ahead does not have to be morbid. You and your family will both feel relieved that you have organized your ‘big day’ and can enjoy the time that you have together with peace of mind.

Alongside life insurance and illness protection plans, did you know that you can get self-employed income protection, which can help protect against accidents, sickness and even unemployment. Let’s say that you’ve had a loss in clients, or have been unwell so have not been able to work, an income protection policy is designed to provide you with tax-free income and can pay out until you are able to return back to work or retire. This income would be at a rate of 50%-70% of your average monthly income when you were working.

Having this kind of insurance in place could protect you from being out of pocket during a difficult time. This could leave you with one less thing to worry about.By getting income protection insurance, self employed people can stop worrying about what’d happen if they were too ill or injured to work, and can mean that you can take a ‘sick day’ or time off, without feeling worried about your earnings.

Build Up An Emergency Fund And Think Ahead

As I said earlier, when you are your own boss, your income varies from month to month. Unlike most employed jobs, where you have the same salary each month, you could earn 3,000 one month, and the next £500. This makes having an emergency fund a priority, because you don’t know what expenses you are going to have. For example, the other week my computer which is less than a year old unexpectedly crashed, and I had to pay out quite a hefty fee to get it fixed. In the same week, my charger broke and I had to pay extra money for travel.

Because I have an emergency fund set up for any unexpected expenses, I was able to cover the costs immediately, and priortize the repair of my computer. Ideally you want to have at least six months worth of savings to cover unexpected repairs, especially if you own a car, computer, a house or any other big purchases, because you don’t want to be left out of pocket! It’s better to set aside extra money each month.

Remember this money does not go torwards your savings, or your everyday expenses, this is to cover large-scale payments. If you have a full time job, and are also self-employed, your emergency fund can contain three months worth of savings. However, when you are a full time freelancer, you need at least six months of savings, to have a safety net in place. But how do you set up an emergency fund?

First of all, determine how much you need to save? I said earlier that six months will help you with the largest costs, but everyone’s financial circumstances are different. For example, maybe you are leaving a full time job to become a freelancer and have a year worth of savings, which you can put aside to use during particularly difficult months, especially when you are first starting out.

To build your emergency fund calculate the total that you want to save. Nerd Wallet have a great ‘savings calculator’ that determines how much you need to save up for emergencies, by asking you 8 questions related to your rent or mortgage, utility bills, expenses and food and travel. It then gives you a ‘figure’ which represents six months of basic living expenses. It then asks you whether this amount is feasible to save.

You should also set a monthly savings goal, which will get you into the habit of saving and making it a regular habit. For example, let’s say you get paid £450 for a blog post, you can set aside £150 of this and transfer it into your savings account. Each time you get a payment for your freelance work, you can immediately add it into your emergency fund account. Once you have enough money saved, you can consider adding a small percentage into your ‘savings account’ or even use some of the money (if in excess) to treat yourself to a well deserved treat.

Have Confidence In Your Finances And Make Smart Choices

The best part about being a freelancer is that you are in control of your own finances, but it’s also important to make the right financial decisions as well. First off, seperating your business and personal finances is vital, so that you can easily track your business expenses and income, which will make filling in self-assessment forms that much easier. Keep track of your freelancer payments, any apps that you use for work, software costs and products brought like a camera and laptop that is vital to your small business.

Financial anxiety is a crippling feeling, so you want to be as well-prepared as possible, making sure that you invest in your future and have complete faith in your work. You can do this by outlining a cohesive ‘financial strategy’ that will help you save money when you are self-employed. For example, one of the most integral things that you can do, is to understand how long your clients will take to pay invoices.

For example, you may have clients who take 24 hours to process payments, 14 days, or 30 days, so I always charge more for clients who take longer to pay and are ‘one off large-scale projects’, whereas more regular clients have a discounted fee, because I know that they will offer me regular work, and are extremely reliable. I am also making a conscious effort to ‘work smarter’ as opposed to working harder, and have created a content calendar for the next few months that will enable me to save money, by making smarter financial choices.

When you have payments scheduled, or content to create, you need to make sure that the cash flow is organized around these dates, so that you can avoid periods of financial difficulty, reduce frustration and avoid charges. To work smarter, and save money when you are self-employed, you can also deliver content ahead of schedule (if you can!), so that you aren’t doing 500 blog posts at once, and can impress your clients, creating opportunities for future work, while giving you a better quality of life. After all who dosen’t want to be financially happy?

Financial planning is also about establishing what your long term goals is. For example, eventually I would like to get to a position where I can work for myself full time again, but be comfortable with my finances this time round, and not have to worry about money. When I was working full time as a blogger, I didn’t diversify my income streams, and relying on just my blog alone meant that I had some very bad financial months, and eventually ended up in debt because I wasn’t earning enough.

Although I have an emergency fund, and have savings, I am still working towards being able to ‘freelance full time’, but build up my clientale, to a level where I feel comfortable enough to try again. It takes a lot of trust in yourself, and it’s important that your financial freedom, is not undermined by money worries and financial anxiety. I know a figure that I would like to earn each month, so once I bypass that in my freelance earnings, I can be confident enough to take the plunge. After all knowing how to save money when you are self employed is key.

Diversify Your Income And Create Multiple Finance Streams

Speaking of saving money, I know from personal experience that you shouldn’t put all your eggs in one basket. That’s why I call myself a Jack of all Trades because I offer a variety of different freelancing services, in order to supplement my freelance income. While when I was blogging full time, I was largely focused on making money from my blog (although I did do blogging events), there were often times when I was working for free. I wasn’t being paid when I was hosting webinars, was a speaker at events, and did a lot of unpaid content creation.

While there are still some things that I might do on an unpaid basis, I do try and limit gifting campaigns, and place an emphasis on paid work. I don’t just take on sponsored posts, content creation and affiliate marketing, but outside of blogging I am building a freelance roster where I offer ghostwriting, blog writing, social media management and creative copywriting services. I have clients in the travel, culture, entertainment, and food and drink industries, so income diversification is really important in order to save money when you are self-employed.

For example, as a blogger, I also run a freelance writing business, have a podcast, and ran events in the past. I can use this to create digital products such as e-books, courses or even workshops to help my audience become a better writer/ editor, and monetize what I am not making money from, to make it profitable. For example, I have written short stories and poems, but have never published them, so this could be something that I could ‘lease out’ to a company like Kindle or Amazon, to make passive income on the side.

You could have a hobby like creating illustrations of people on Instagram, which you can turn into a profitable side business, by turning instagrammers into cartoon characters, historical figures or anything else that would set your ‘illustration’ business apart from the rest. By monetizing your hobby, you can eventually turn your side business into a full time job, whilst working for yourself!

Of course, while diversifying your income will help you save money when you are self-employed, it’s also important to take into account time management. Only you know your workload, the speed that you work at and how much time you will need to invest in these ‘multiple financial streams’, so that’s important to bear in mind. Your main business or goal should always be a priority of course, as it is better to do one or two things well, than do five things and not do them at the level that you would like.

How Do You Save Money When You Are Self-Employed?

*Disclaimer

Please note this is a collaborative post but all thoughts are my own and are not affected by monetary compensation. Please share below if you have any tips on ways to save money when you are self-employed, or are looking to become a freelancer.

Great ideas for the self-employed workforce! I love that you mention having an emergency fund. So so important!

Great tips for a self employe plus a mom to be 🙂 Thank you for sharing!!

I’m happy that you included things like life insurance, health insurance, and self-employment insurance. And of course, saving money in an emergency fund. Many self-employed people do not consider these things. And they get stuck in a situation where they are overwhelmed by bills they cannot pay.

I need to start doing this to save money!

These are great ideas to help save money for self-employed people. It’s important to know ways to make your money go further and save where you can no matter what you do.

These are great ideas on how to save money for self-employed individuals. It is important to always have an emergency fund for the rainy days!

Nice article. Being a finance nut myself, I can’t agree more on the importance of a budget and a good emergency fund. Both of those are the foundation the rest of your finances rely on.

Thanks for the helpful tips!

Thanks for the many suggestions to cut spending while working at home. I am definitely going to change some of my spending habits.

There are plenty of great ideas on how self-employed individuals can save money.

Thanks for the helpful tips!